Smarter, faster R&D claims for top UK advisors

Deliver compliant, defensible claims in record time - powered by Claimer’s AI-driven platform

THE #1 SELECTED R&D TAX SOFTWARE

Smarter, faster R&D claims for top UK advisors

Deliver compliant, defensible claims in record time - powered by Claimer’s AI-driven platform

THE #1 SELECTED R&D TAX SOFTWARE

Smarter, faster R&D claims for top UK advisors

Deliver compliant, defensible claims in record time - powered by Claimer’s AI-driven platform

THE #1 SELECTED R&D TAX SOFTWARE

Claimer is becoming the industry standard

Within the UK, 30% of advisor-submitted R&D claims involve Claimer's technology.

Claimer is the trusted technology partner of top 20 accountancy firms and 50+ R&D tax credit consultancies, large and small.

"The narrative it develops is brilliant, particularly in converting some of the client text into more concise HMRC terminology. Really, really good, from the fact-find to the narrative."

"The narrative it develops is brilliant, particularly in converting some of the client text into more concise HMRC terminology. Really, really good, from the fact-find to the narrative."

"The narrative it develops is brilliant, particularly in converting some of the client text into more concise HMRC terminology. Really, really good, from the fact-find to the narrative."

Darryl Hoy, Shorts Accountants (Ex-HMRC R&D inspector)

Darryl Hoy, Shorts Accountants (Ex-HMRC R&D inspector)

Darryl Hoy, Shorts Accountants (Ex-HMRC R&D inspector)

"Easy to use, seamless performance, and great customer support."

"Easy to use, seamless performance, and great customer support."

"Easy to use, seamless performance, and great customer support."

Khaled Takrouri, Wilson Partners

Khaled Takrouri, Wilson Partners

Khaled Takrouri, Wilson Partners

We give R&D tax advisors superpowers

Claimer’s AI-driven automation slots within your existing process to deliver unmatched efficiency gains whilst reducing errors.

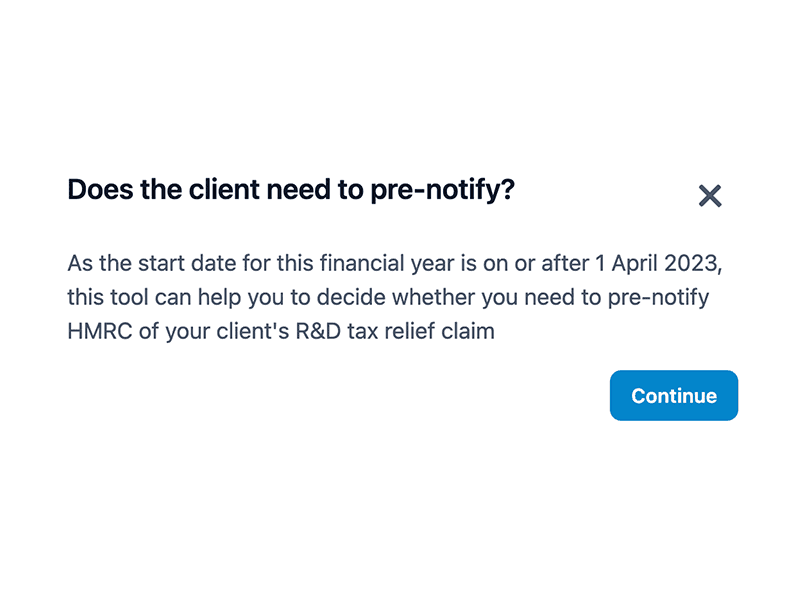

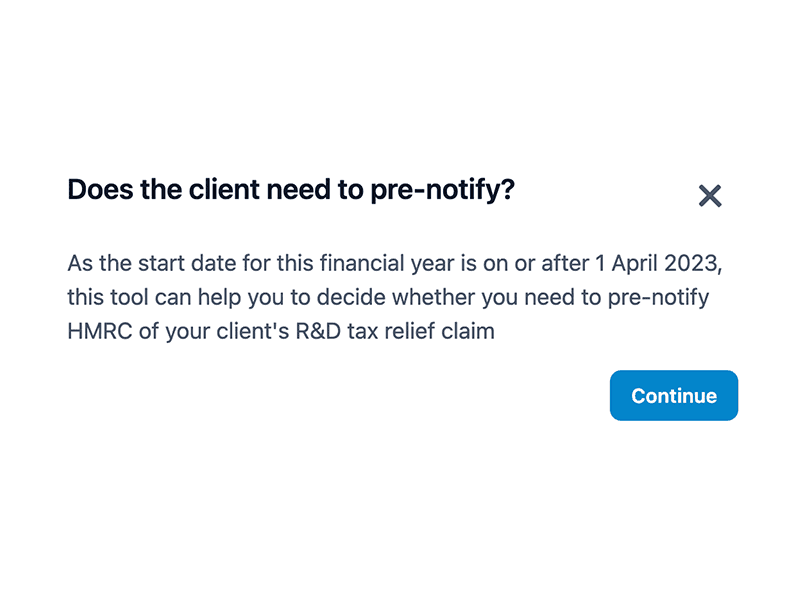

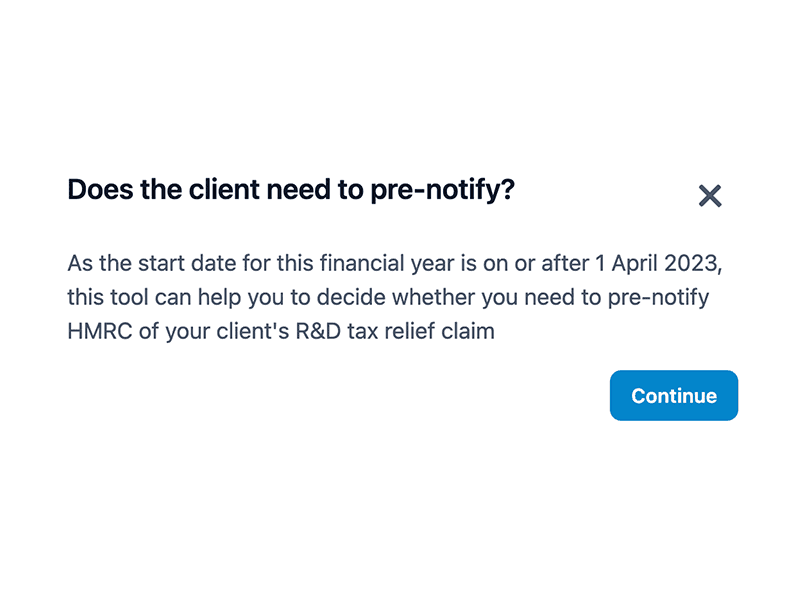

Claim notifications:

Sorted

Claim notifications:

Sorted

Claim notifications:

Sorted

Never miss a deadline, determine the need to notify, and submit through Claimer.

Never miss a deadline, determine the need to notify, and submit through Claimer.

Never miss a deadline, determine the need to notify, and submit through Claimer.

Tech narratives:

Bulletproof

Tech narratives:

Bulletproof

Tech narratives:

Bulletproof

AI-driven eligibility, information gathering, and comprehensive narrative drafting.

AI-driven eligibility, information gathering, and comprehensive narrative drafting.

AI-driven eligibility, information gathering, and comprehensive narrative drafting.

R&D financials:

Meticulous

R&D financials:

Meticulous

R&D financials:

Meticulous

Effortlessly gather, allocate, and approve financial and company information.

Effortlessly gather, allocate, and approve financial and company information.

Effortlessly gather, allocate, and approve financial and company information.

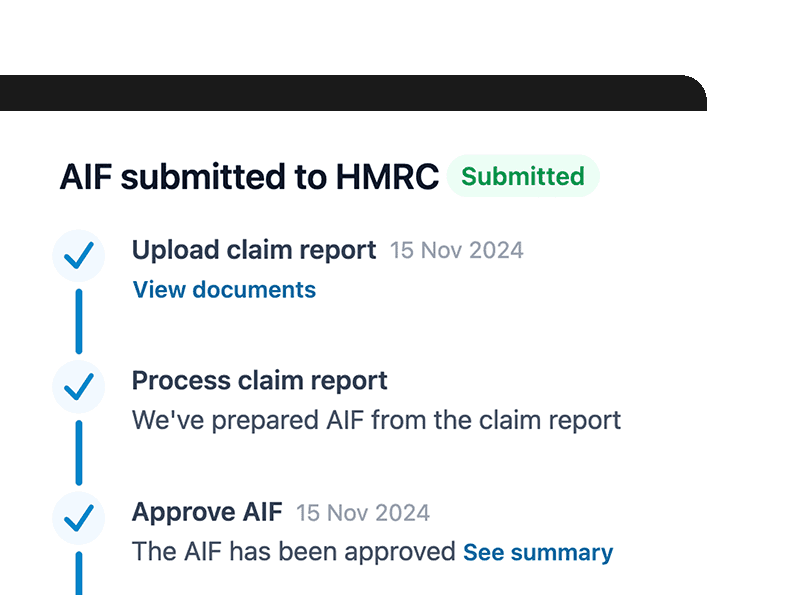

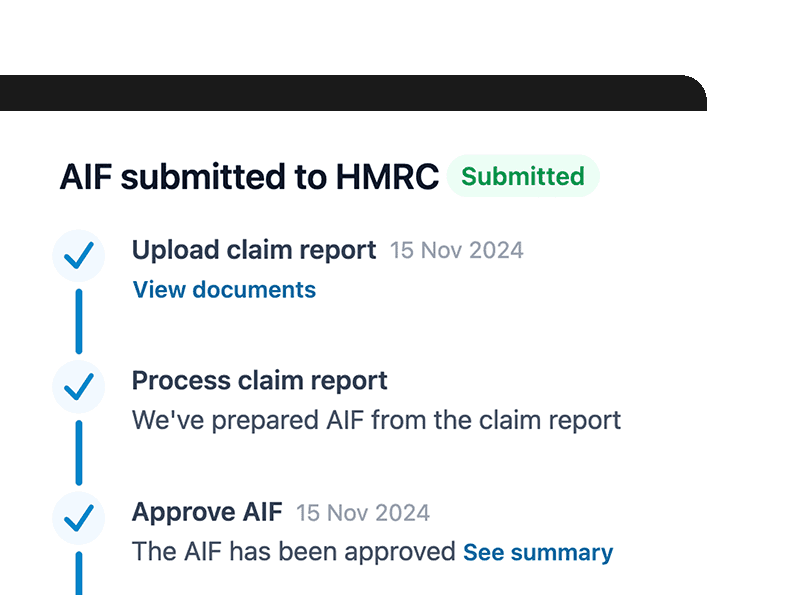

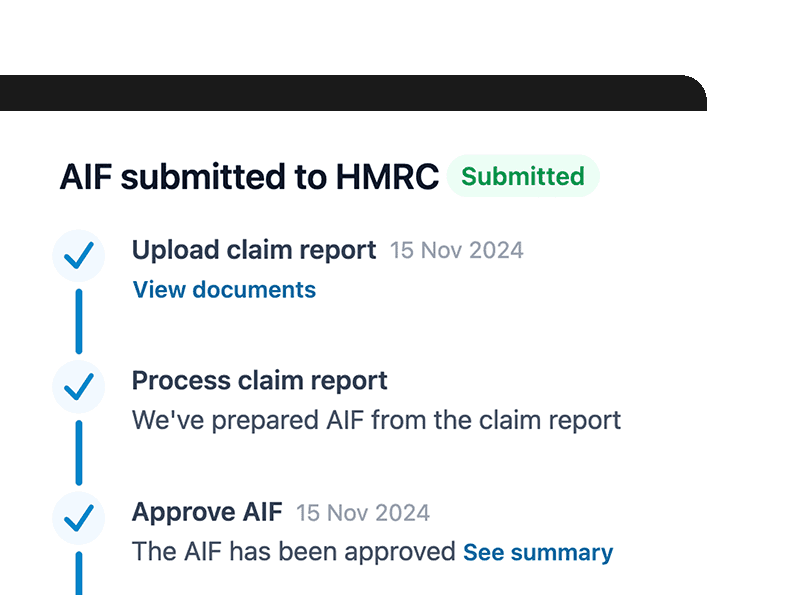

Additional Info Form:

Headache gone

Additional Info Form:

Headache gone

Additional Info Form:

Headache gone

Auto-populate, validate, and submit AIFs in 1-click. AIF form updates taken care of.

Auto-populate, validate, and submit AIFs in 1-click. AIF form updates taken care of.

Auto-populate, validate, and submit AIFs in 1-click. AIF form updates taken care of.

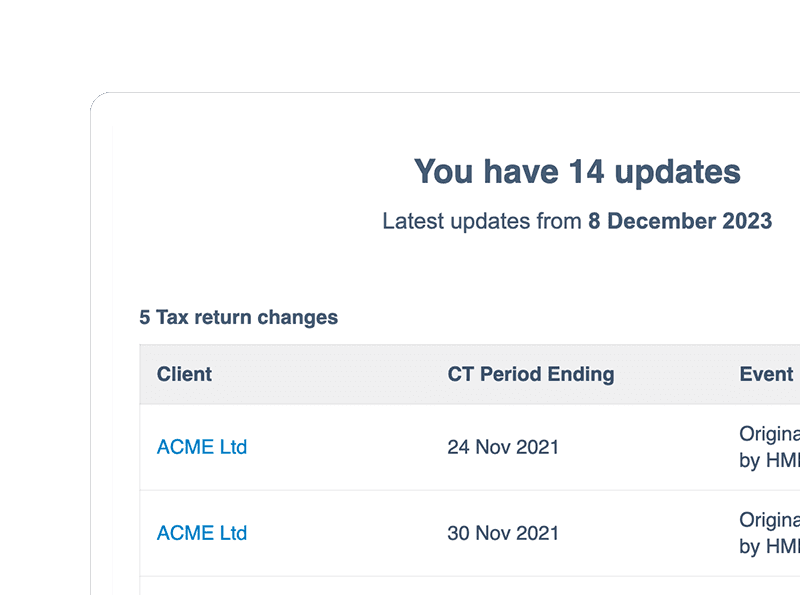

R&D Claim progress:

Tracked

R&D Claim progress:

Tracked

R&D Claim progress:

Tracked

Proactively monitor when any client's claim is recieved, processed, and paid via HMRC.

Proactively monitor when any client's claim is recieved, processed, and paid via HMRC.

Proactively monitor when any client's claim is recieved, processed, and paid via HMRC.

Proven tools to grow your firm

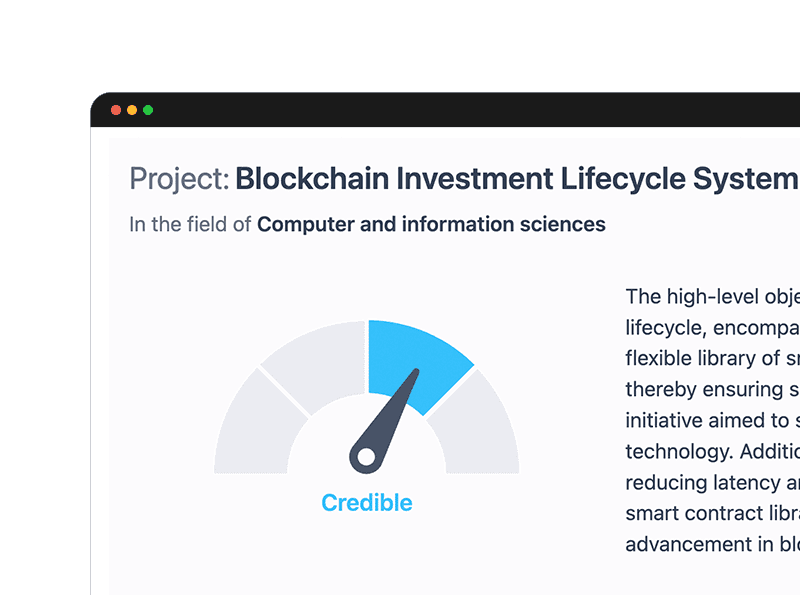

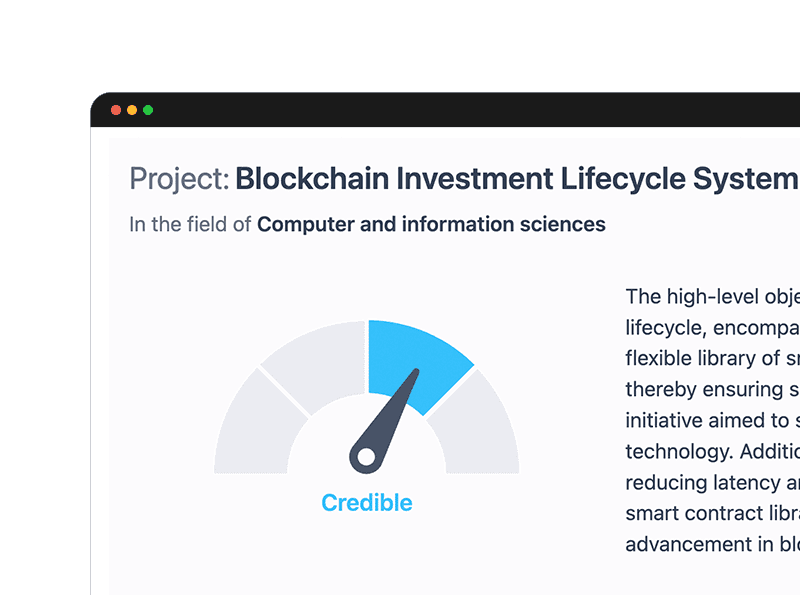

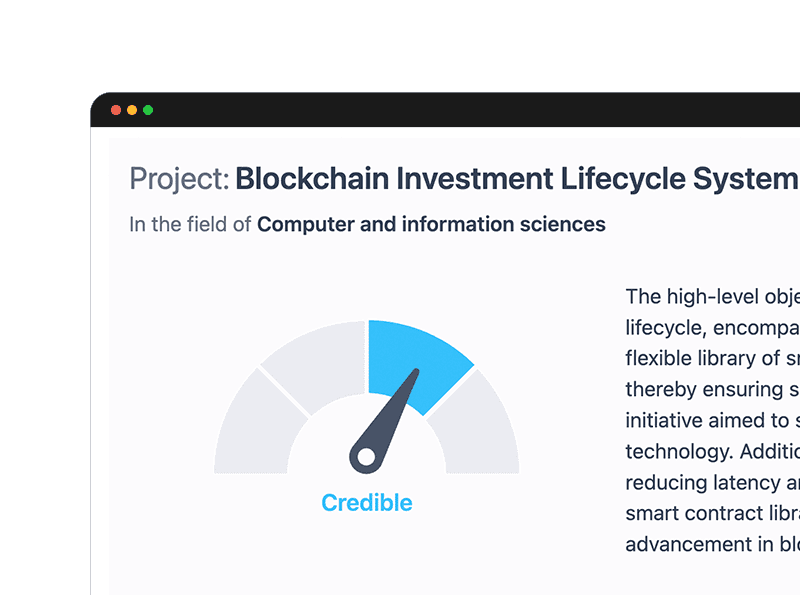

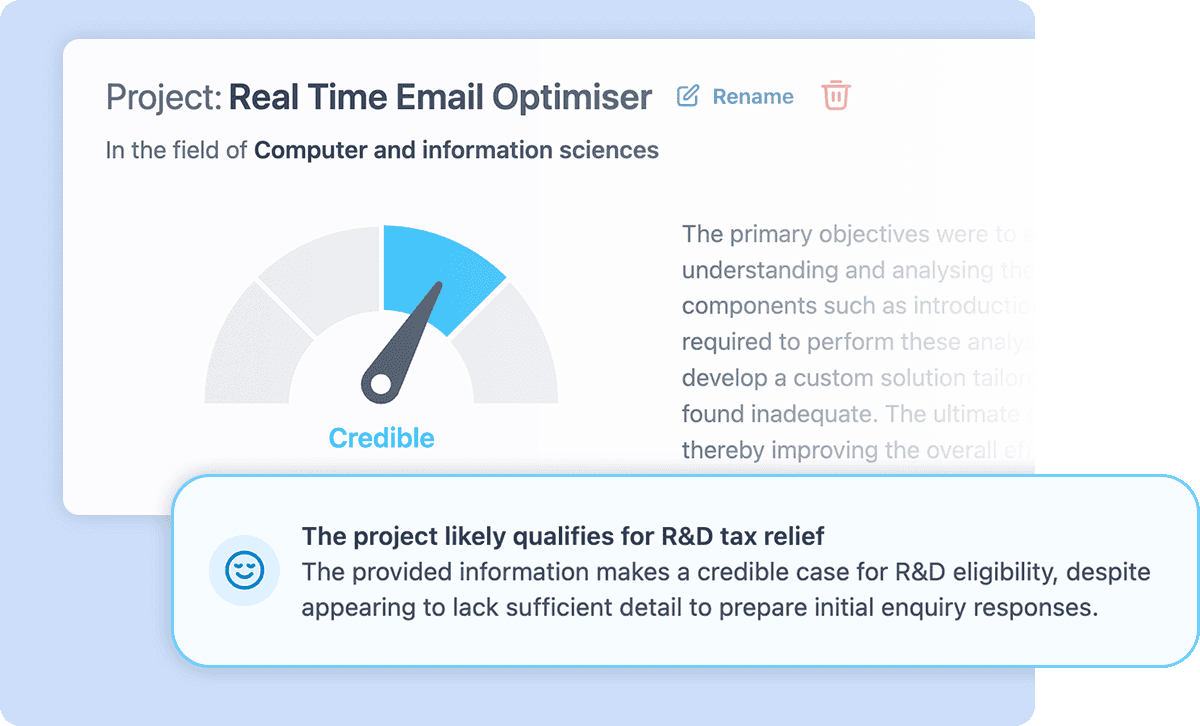

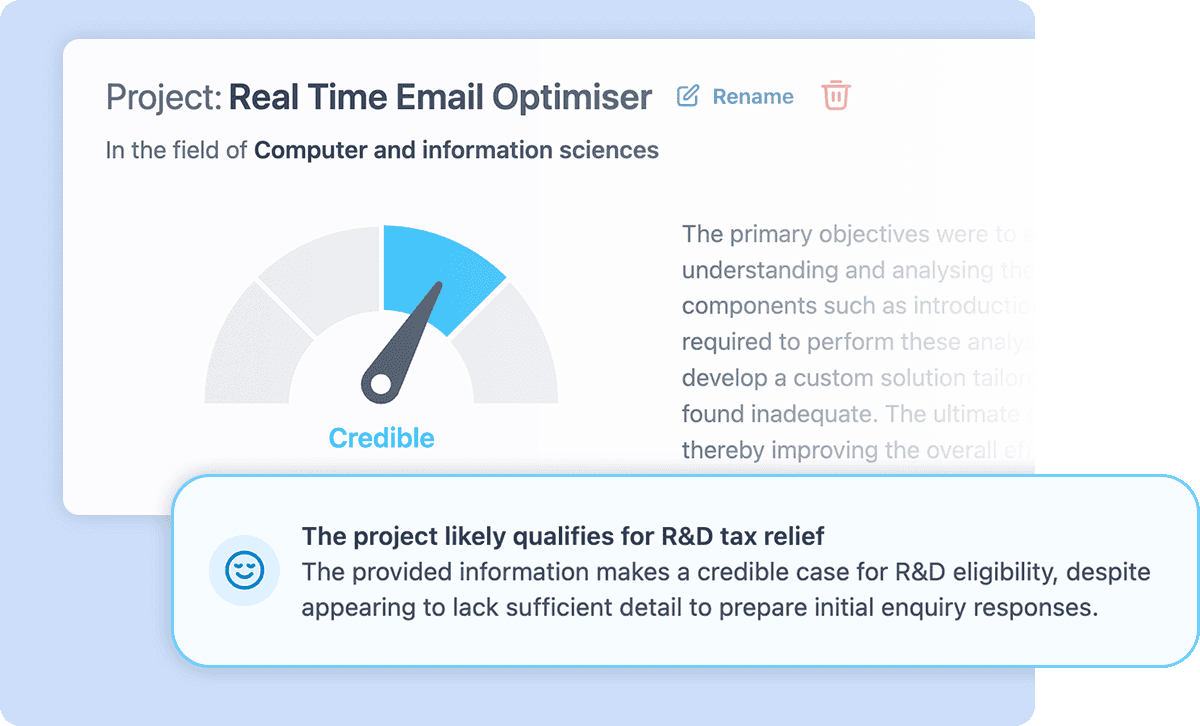

Accurately assess eligibility.

Identify the strength of projects and their likelihood of passing an enquiry in seconds.

Utilising HMRC internal and external guidance and Claimer's in-house training data of 800+ claims and 70+ enquiries

Quickly determine the strongest qualifying projects

Identify any suitable competent professionals

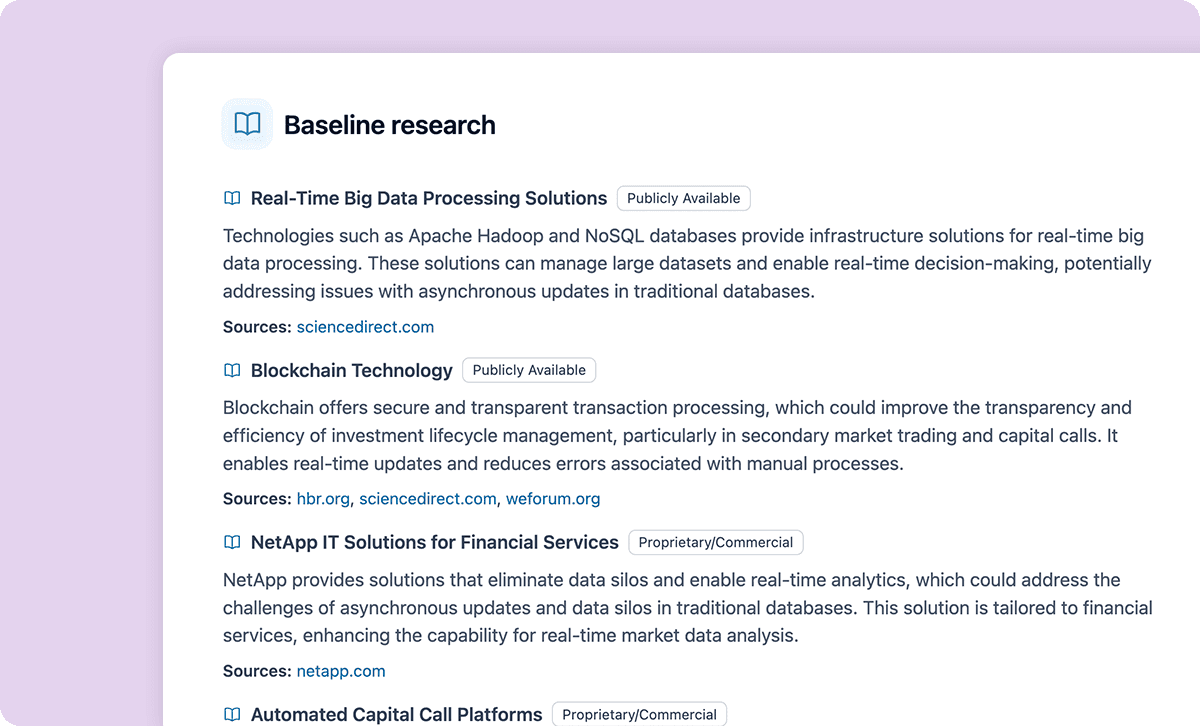

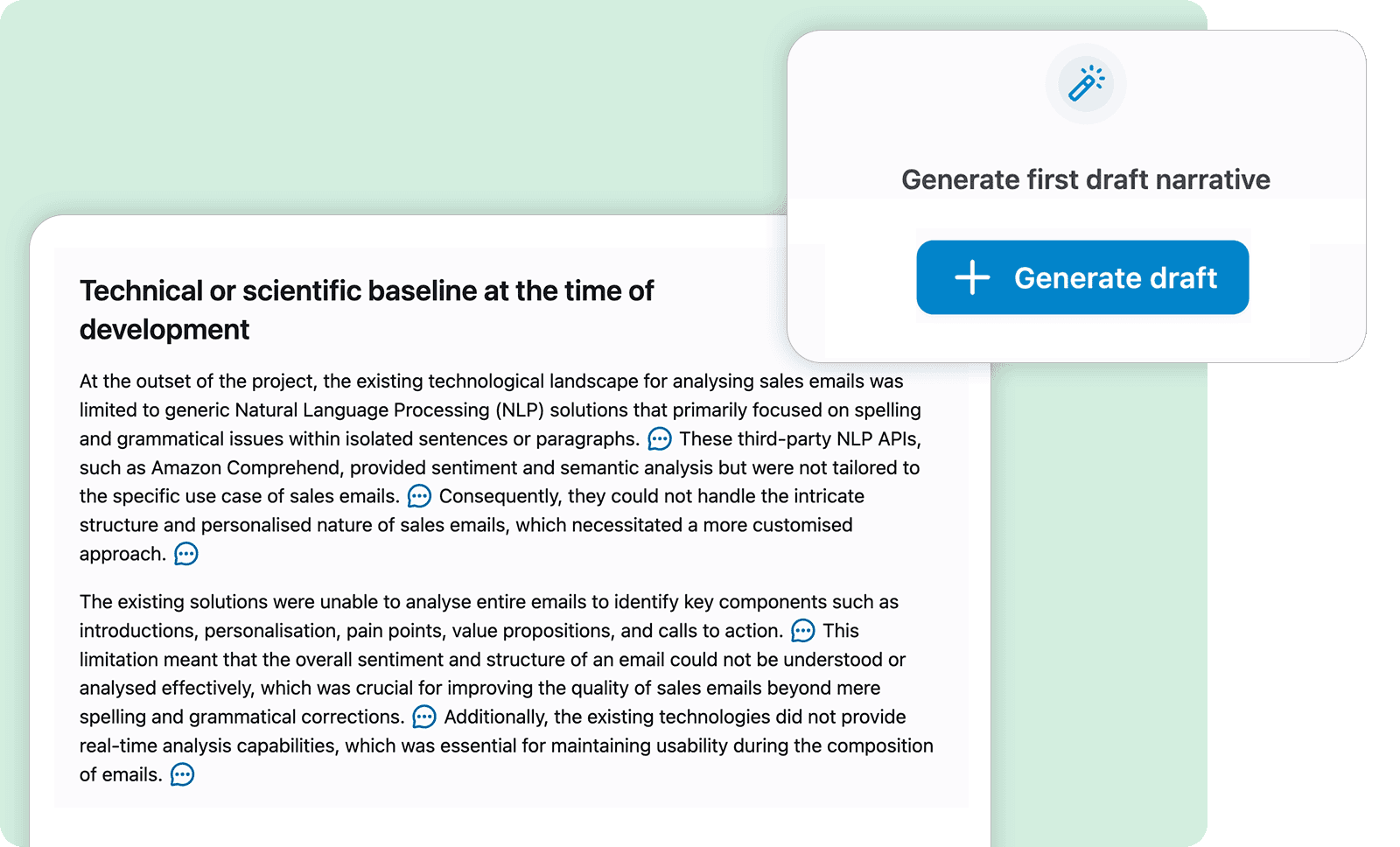

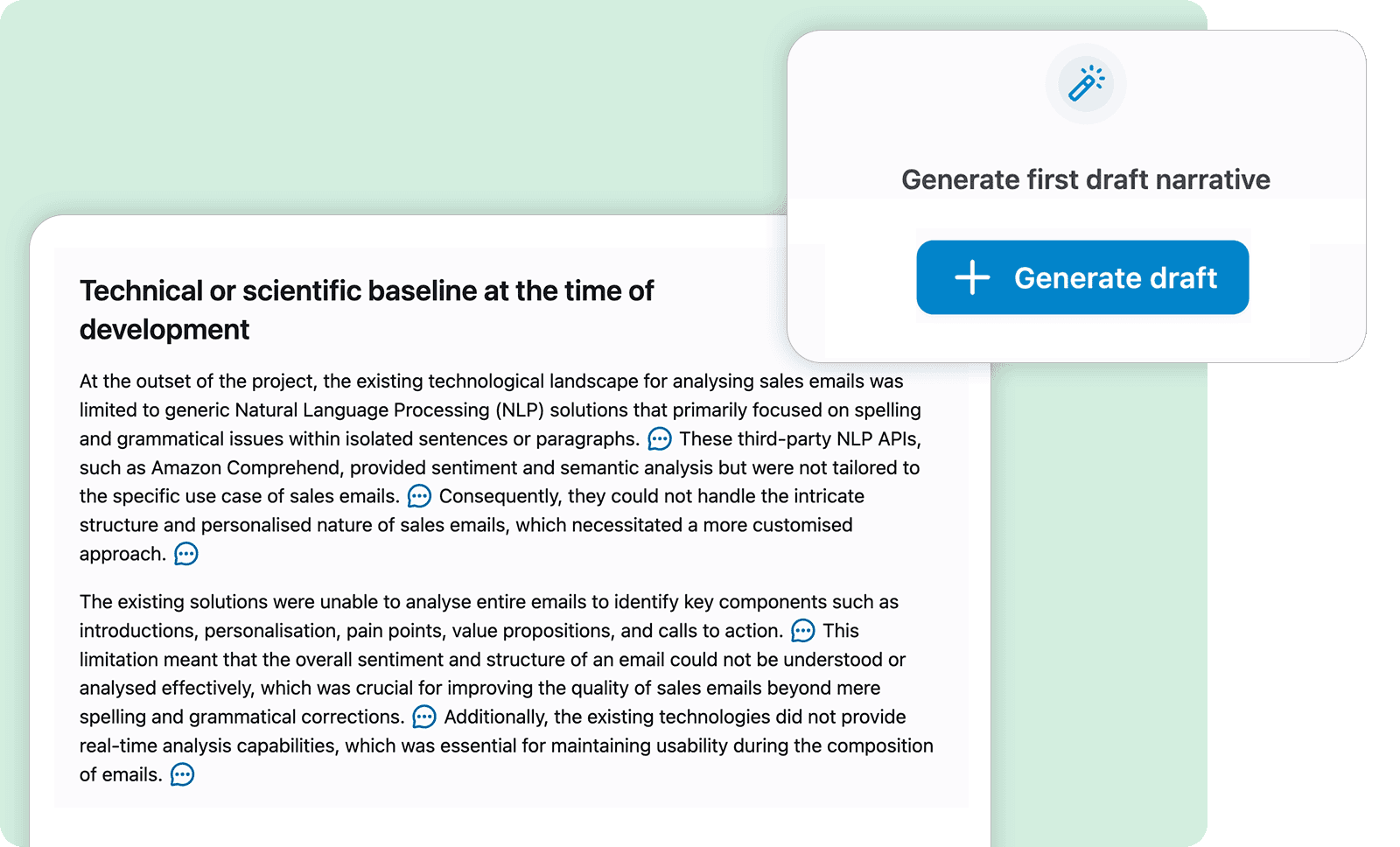

Build incredibly robust R&D narratives.

By deeply understanding your client’s project and field, Claimer is able to guide you into producing industry-leading R&D technical narratives that stand up to HMRC scrutiny.

Detailed risk analysis provides insight into weak areas and how they could be strengthened

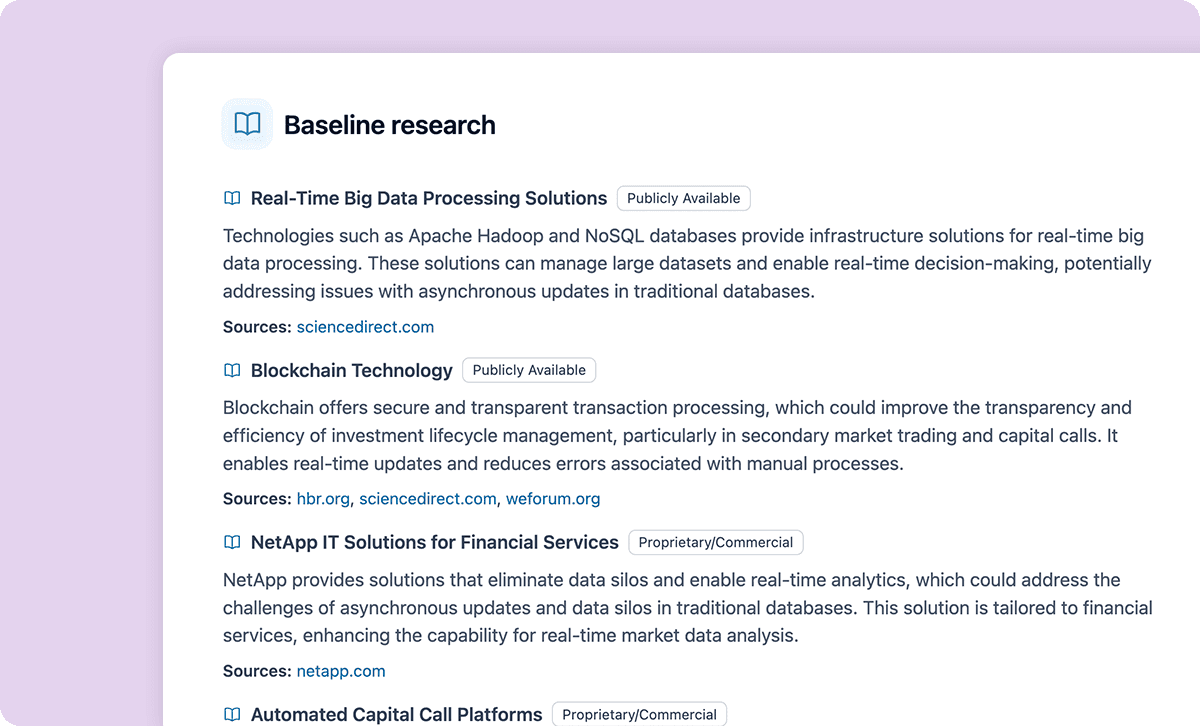

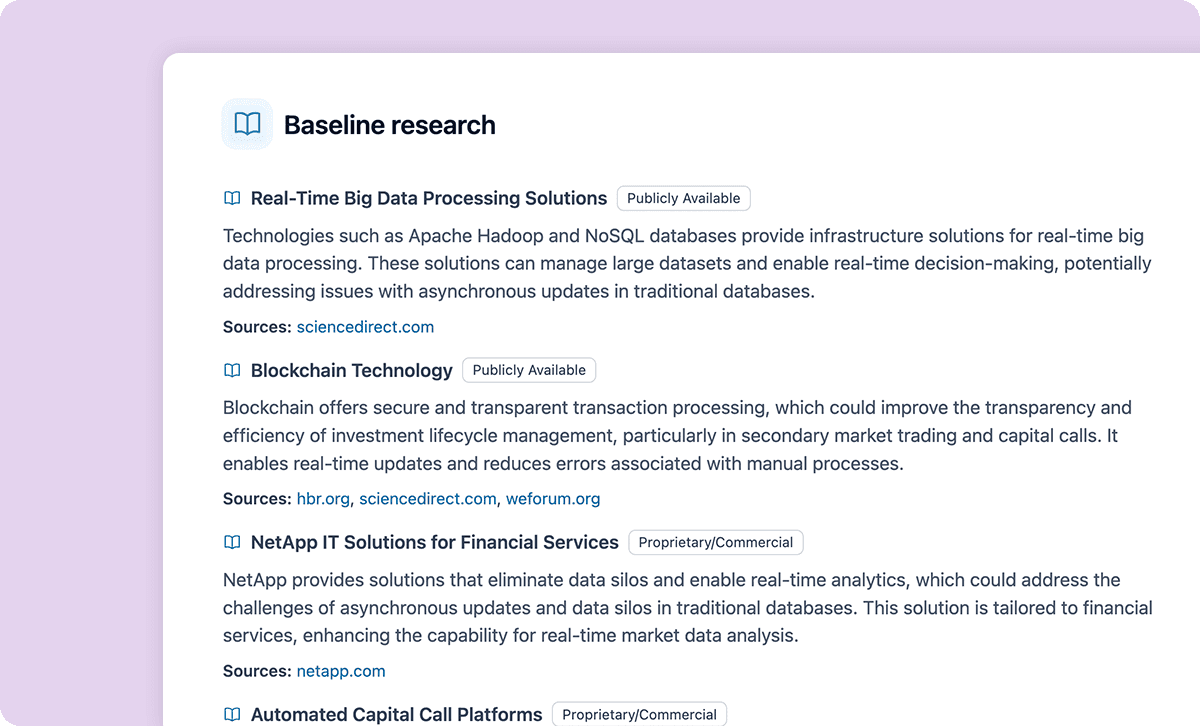

Automatically scans billions of documents in the public domain to identify and validate baseline technologies at the time of the project

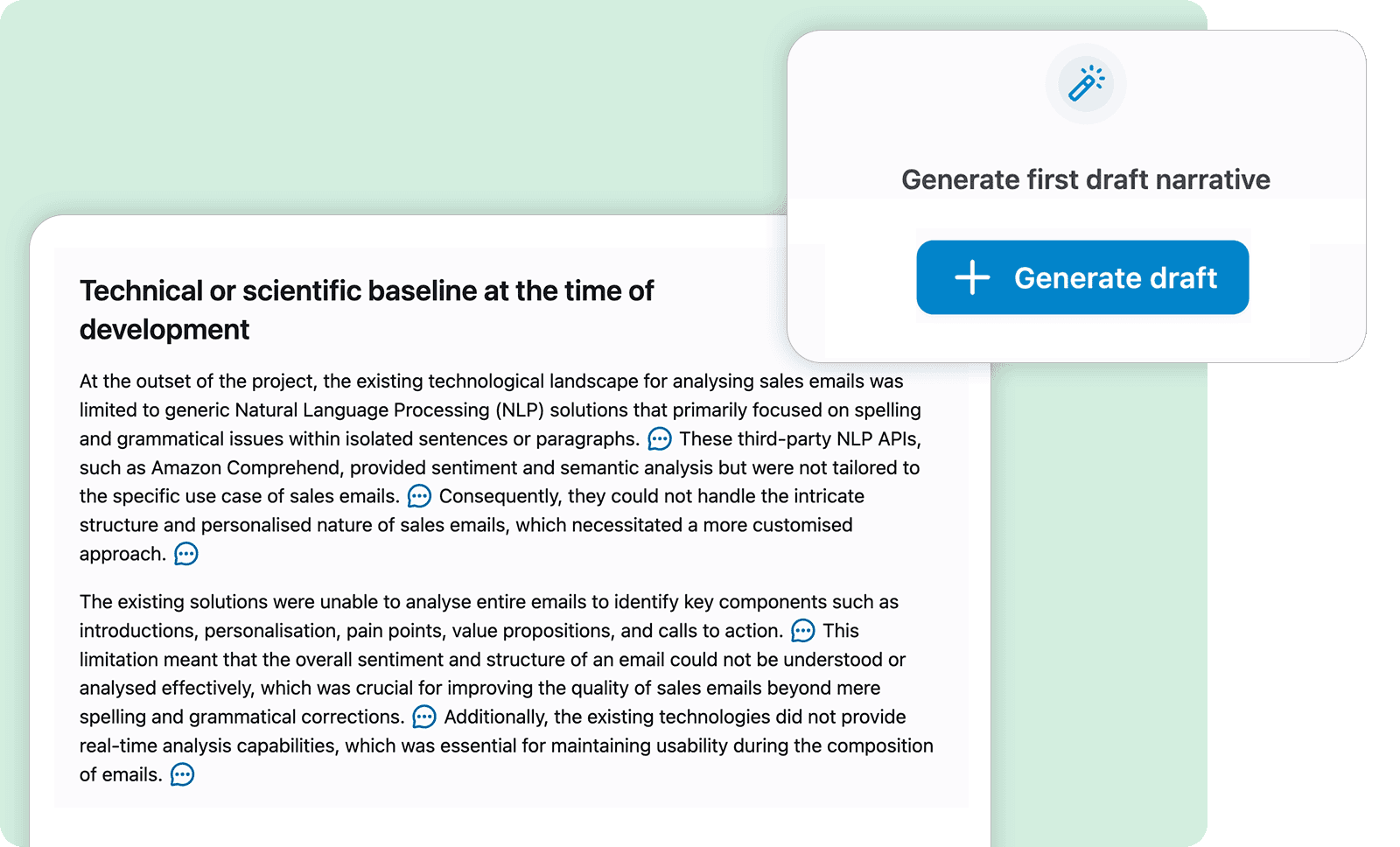

No more drafting.

The days of starting from a blank page or generic template are over. Edit your pre-structured and comprehensive technical narrative to produce a polished gem in minutes.

AIF-compatible, HMRC-compliant narrative structure

Anti-hallucination technology gives you confidence in the produced draft

Easily transfer the narrative to your chosen editor or report template

Discover how top advisors streamline narrative preparation with Claimer.

Accurately assess eligibility.

Identify the strength of projects and their likelihood of passing an enquiry in seconds.

Utilising HMRC internal and external guidance and Claimer's in-house training data of 800+ claims and 70+ enquiries

Quickly determine the strongest qualifying projects

Identify any suitable competent professionals

Build incredibly robust R&D narratives.

By deeply understanding your client’s project and field, Claimer is able to guide you into producing industry-leading R&D technical narratives that stand up to HMRC scrutiny.

Detailed risk analysis provides insight into weak areas and how they could be strengthened

Automatically scans billions of documents in the public domain to identify and validate baseline technologies at the time of the project

No more drafting.

The days of starting from a blank page or generic template are over. Edit your pre-structured and comprehensive technical narrative to produce a polished gem in minutes.

AIF-compatible, HMRC-compliant narrative structure

Anti-hallucination technology gives you confidence in the produced draft

Easily transfer the narrative to your chosen editor or report template

Discover how top advisors streamline narrative preparation with Claimer.

Accurately assess eligibility.

Identify the strength of projects and their likelihood of passing an enquiry in seconds.

Utilising HMRC internal and external guidance and Claimer's in-house training data of 800+ claims and 70+ enquiries

Quickly determine the strongest qualifying projects

Identify any suitable competent professionals

Build incredibly robust R&D narratives.

By deeply understanding your client’s project and field, Claimer is able to guide you into producing industry-leading R&D technical narratives that stand up to HMRC scrutiny.

Detailed risk analysis provides insight into weak areas and how they could be strengthened

Automatically scans billions of documents in the public domain to identify and validate baseline technologies at the time of the project

No more drafting.

The days of starting from a blank page or generic template are over. Edit your pre-structured and comprehensive technical narrative to produce a polished gem in minutes.

AIF-compatible, HMRC-compliant narrative structure

Anti-hallucination technology gives you confidence in the produced draft

Easily transfer the narrative to your chosen editor or report template

Discover how top advisors streamline narrative preparation with Claimer.

Enterprise-grade security & privacy first approach

Enterprise-grade security & privacy first approach

Enterprise-grade security & privacy first approach

Stringent security and data protection measures keep your data safe.

Stringent security and data protection measures keep your data safe.

Stringent security and data protection measures keep your data safe.

Integrate Claimer with your existing systems

Integrate Claimer with your existing systems

Integrate Claimer with your existing systems

Use Claimer's API to achieve the best of both worlds: unprecedented AI-driven automation in R&D tax, whilst still utilising the legacy systems you are familiar with.

Use Claimer's API to achieve the best of both worlds: unprecedented AI-driven automation in R&D tax, whilst still utilising the legacy systems you are familiar with.

Use Claimer's API to achieve the best of both worlds: unprecedented AI-driven automation in R&D tax, whilst still utilising the legacy systems you are familiar with.

Become a better R&D tax advisor with Claimer's game-changing technology

Become a better R&D tax advisor with Claimer's game-changing technology

Become a better R&D tax advisor with Claimer's game-changing technology

© Claimer Tech Ltd. 2025.

© Claimer Tech Ltd. 2025.

© Claimer Tech Ltd. 2025.